Table Of Content

Comparing rates and fees from several lenders is important, not only from traditional lenders such as local banks, but also Fintech lenders. Importantly, when comparing offers, homebuyers need to take into account other costs beyond principal and interest payments. With an adjustable rate, the rate is steady for a set number of years (often five or seven), and then can change every adjustment period (often once per year). If that rate goes up or down, so does the interest rate on your loan. Adjustable-rate mortgages are typically cheaper than fixed-rate mortgages during the first few years, but have the potential to cost you a lot more in the long run. Be careful not to confuse interest rates and APR — both are expressed as a percentage, but they’re very different.

How do I get the best mortgage rate?

The total is divided by 12 months and applied to each monthly mortgage payment. If you know the specific amount of taxes, add as an annual total. If you roll the closing costs and other borrowing fees into your loan, you may pay a higher interest rate than someone who pays those fees upfront. Loans that are smaller or larger than the limits for conforming loans may pay higher interest rates too.

Compare our picks for the best mortgage lenders

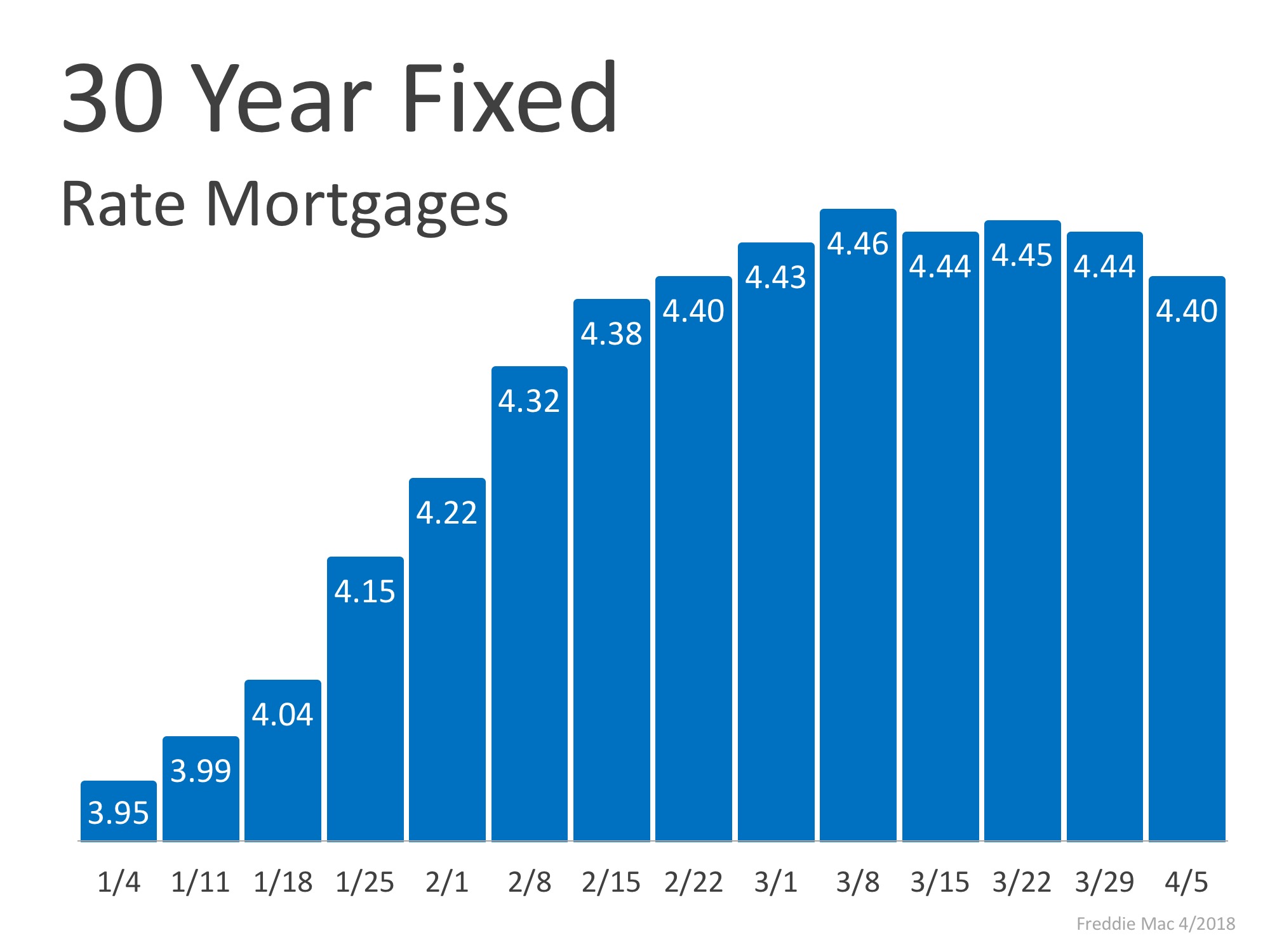

Lock in low rates currently available and save for years to come! If you secure a fixed mortgage rate your payments won't be impacted by future rate hikes. By default we show 30-year purchase rates for fixed-rate mortgages. You can switch over to refinance loans using the [Refinance] radio button.

Sample loan programs

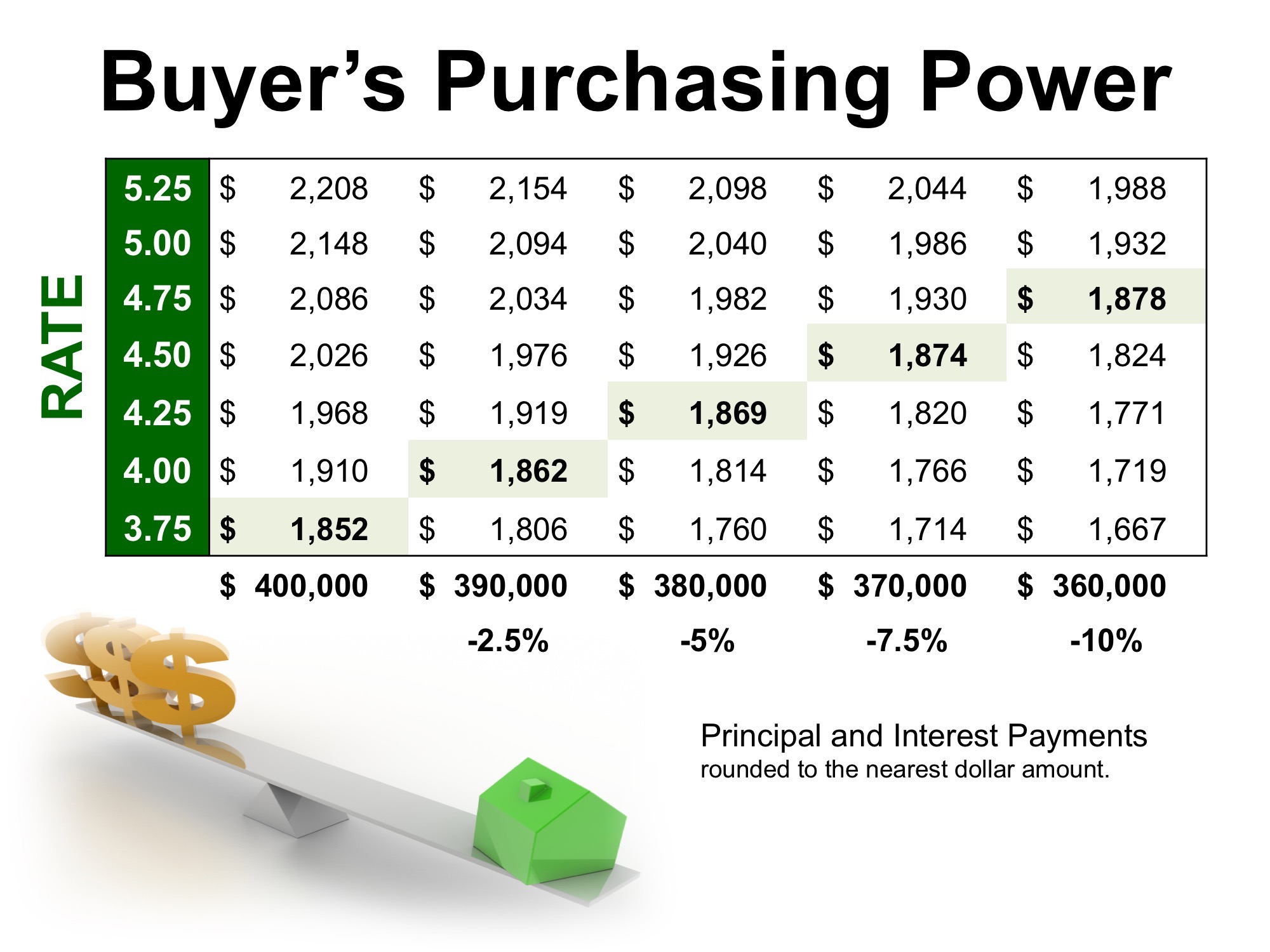

We love helping people understand how rates work and what yours could be. "We got great, attentive service, and importantly, a very competitive rate that we were happy with." "was easy to upload documentation, i got a great rate, and am extremely happy with the service." In this example, if your budget is $2,000 per month and rates rise to 9%, you might have to shop for a home with a lower price tag. Bankrate has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover. Understanding how much you can afford is a great first step to buying a home.

And VA loans and USDA loans are available with zero down payment. But if you can put 10, 15, or even 20% down, you might qualify for a conventional loan with low or no private mortgage insurance and seriously reduce your housing costs. While the broader trends provide valuable context, it’s important to recognize that average mortgage rates are just a benchmark. Borrowers with healthy credit profiles and strong finances often get mortgage rates well below the industry norm. Check out some of our best HELOC lenders to start your search for the right loan for you.

Vehicle loans

Ultimately, if homebuyers are looking to get the best price on a home, they should exercise caution if paying for a home with cash, or instead take advantage of historically low mortgage rates. A mortgage rate is the percentage a lender charges on the money you owe for the purchase of real estate. The lender multiplies the mortgage rate by the amount you still owe to determine how much interest you'll pay each month. You can compare current mortgage rates between lenders by applying for mortgage pre-approval with each lender you're considering. A smaller down payment doesn't always mean you'll have to settle for a higher rate, though. The interest rates for low down payment loans (like an FHA loan or a VA loan) can be very competitive.

Get more with Bank of America home loans

Finally, your individual credit profile also affects the mortgage rate you qualify for. It can be tricky to time any market, and mortgage rates are no exception. If conditions are choppy, and interest rates are likely to rise, it may be smart to lock in a rate that works with your budget and seems fair to you. Whether or not 2024 will be a good time to refinance depends on several factors, including if the Fed cuts interest rates this year and by how much. The mortgage rate you got when you financed your home is another major factor.

Best HELOC Rates Of April 2024 – Forbes Advisor - Forbes

Best HELOC Rates Of April 2024 – Forbes Advisor.

Posted: Fri, 26 Apr 2024 12:34:00 GMT [source]

A mortgage rate shows you the amount of money you’ll have to pay as a fee for borrowing funds to purchase a home, and is typically expressed as a percentage of the total amount you’ve borrowed. Keep in mind, the 30-year mortgage may have a higher interest rate than the 15-year mortgage, meaning you'll pay more interest over time since you're likely making payments over a longer period of time. Additionally, spreading the principal payments over 30 years means you'll build equity at a slower pace than with a shorter term loan.

The average cost of a 15-year, fixed-rate mortgage has also surged to 6.55%, compared to 2.43% in January 2022. The average mortgage rate for a 30-year fixed is 7.12%, nearly double its 3.22% level in early 2022. If you’re considering refinancing to lower your monthly payment, keep in mind that not all options yield less interest over the life of the loan. Over the past two years, mortgage rates have skyrocketed to their highest levels in decades amid the Fed’s efforts to tame inflation through aggressive interest rate policy actions. Rates have recently begun to recede—albeit sluggishly—due partly to the Fed’s rate-hike pauses.

Thousands of mortgage lenders are competing for your business. So to make sure you get the best mortgage rates is to apply with at least three lenders and see which offers you the lowest rate. Once you find a rate that is an ideal fit for your budget, it’s best to lock in the rate as soon as possible, especially when mortgage rates are predicted to increase. While it’s not certain whether a rate will go up or down between weeks, it can sometimes take several weeks to months to close your loan.

Most forecasting models predict that mortgage rates will remain above 6% in 2024, potentially dropping further in 2025. Whether or not the Federal Reserve loosens its monetary policy will play a significant role in determining the direction of interest rates. As we head into the spring home buying season, the 2024 outlook for mortgage rates is mainly optimistic, although most experts expect only a small decline.

Lenders set the interest rates for their own loan products based on influence from the Federal Reserve, the economy and consumer demand. If the Federal Reserve raises or lowers the short-term rates to guide the economy, lenders may adjust their mortgage rates as well. Individual circumstances like credit score, down payment and income, as well as varying levels of risk and operational expenses for lenders, can also affect mortgage rates. Your credit score measures your likelihood of making continuous, on-time mortgage payments. Homebuyers with higher credit scores seem less risky to lenders.

Recent economic data suggest that a Fed rate cut might not happen now until next year. Fox says his models suggest that rates will hover at 7.5% or higher throughout 2024. The good news is that, despite elevated rates, there are methods you can employ to secure a lower rate. These methods might be especially beneficial if you bought a home between mid-October and early November 2022 or mid-August through early December 2023 when rates were over 7%. Here’s how refinance activity has trended recently, according to the MBA’s Weekly Mortgage Applications Survey. Even so, Cohn expects the Fed to start cutting rates in June or July.

No comments:

Post a Comment