Table Of Content

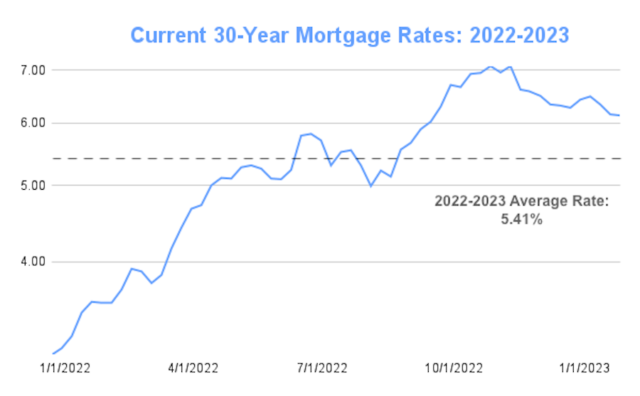

While it may not seem like much, even a half of a percentage point increase can amount to a significant amount of money. The rates and monthly payments shown are based on a loan amount of $464,000 and a down payment of at least 25%. Learn more about how these rates, APRs and monthly payments are calculated. Plus, see a conforming fixed-rate estimated monthly payment and APR example. The average 30-year fixed mortgage interest rate is 7.30%, which is an increase of 18 basis points from one week ago.

Mortgage Rates Chart Historical and Current Rate Trends - The Mortgage Reports

Mortgage Rates Chart Historical and Current Rate Trends.

Posted: Fri, 12 Apr 2024 07:00:00 GMT [source]

Rates increase Mortgage rates for today, April 25, 2024

Supply chain shortages related to the pandemic and Russia’s war on Ukraine caused inflation to shoot up in 2021 and 2022. A resilient economy and robust job market also drive inflation higher and increase demand for mortgages. However, the Federal Reserve has indicated it will begin cutting rates in 2024 as the economy cools and inflation continues to fall. Assuming these trends hold steady, you can expect to see lower mortgage rates in 2024. Her work has been published or syndicated on Forbes Advisor, SoFi, MSN and Nasdaq, among other media outlets. She adds that if the inflation rate holds at 2%, then we should see mortgage rates remain at lower levels for the balance of the next five years.

Why are mortgage rates so high?

While it’s important to monitor mortgage rates if you’re shopping for a home, remember that no one has a crystal ball. It’s impossible to time the mortgage market, and rates will always have some level of volatility because so many factors are at play. A quick way to determine if you should refinance is to estimate your out-of-pocket cost to refinance and divide by your monthly payment savings -- how much your payment goes down due to the refinance.

Mortgages

Meanwhile, many borrowers are sitting on the historically low mortgage rates they nabbed during the pandemic. Those rock-bottom rates are unlikely to return anytime soon—if at all—resulting in limited motivation for many homeowners to refinance. Despite mortgage rates remaining stubbornly high, most housing market experts expect them to recede over 2024, assuming the Federal Reserve acts on its signaled interest rate cuts. However, whether mortgage rates fade enough to create a meaningful shift in home affordability remains uncertain. You can also use a mortgage calculator with taxes, insurance, and HOA dues included to estimate your total mortgage payment and home buying budget.

Personalized versus average interest rates

By the end of March, the average 30-year fixed rate of 6.79% was close to half a percentage point higher than the same week a year ago, and refinance rates tend to be higher than purchase rates. Adjustable-rate mortgages traditionally offer lower introductory interest rates compared to a 30-year fixed-rate mortgage. However, those rates are subject to change after the initial fixed-rate period. An initially low ARM rate could rise substantially after 5, 7, or 10 years. For example, with a credit score of 580, you may qualify only for a government-backed loan such as an FHA mortgage. FHA loans have low interest rates, but come with mortgage insurance no matter how much money you put down.

Emergency actions by the Federal Reserve helped push mortgage rates below 3% and kept them there. So rather than looking only at average rates, check your personalized rates to see what you qualify for. Current HELOC rates are relatively low compared to other loan options, including credit cards and personal loans. A HELOC is a line of credit that lets you borrow against the equity in your home. It works similarly to a credit card in that you borrow what you need rather than getting the full amount you're borrowing in a lump sum.

Bankrate logo

The average 30-year fixed-refinance rate is 7.30 percent, up 23 basis points over the last seven days. A month ago, the average rate on a 30-year fixed refinance was lower at 6.91 percent. While borrowers shunned ARMs during the pandemic days of super-low rates, this type of loan has made a comeback as mortgage rates have risen. The average 15-year fixed-mortgage rate is 6.74 percent, up 20 basis points over the last week.

Mortgage Rates Today: April 23, 2024—Rates Remain Fairly Steady

It also lets you tap into the money you have in your home without replacing your entire mortgage, like you'd do with a cash-out refinance. VA loans are partially backed by the Department of Veterans Affairs, allowing eligible veterans to purchase homes with zero down payment (in most cases) at competitive rates. Homeowners in some developments and townhome or condominium communities pay monthly Homeowner's Association (HOA) fees to collectively pay for amenities, maintenance and some insurance. We offer a wide range of loan options beyond the scope of this calculator, which is designed to provide results for the most popular loan scenarios.

However, a cut likely won’t materialize until summer, at the earliest. We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey.

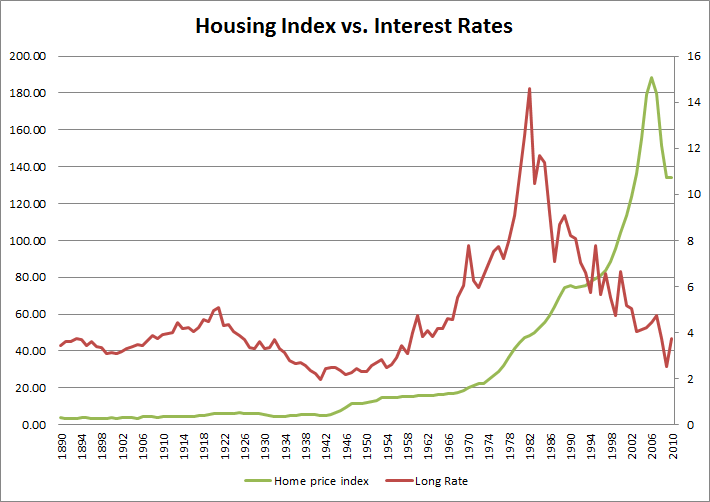

I’ve had a front-row seat for two housing booms and a housing bust. I’ve twice won gold awards from the National Association of Real Estate Editors, and since 2017 I’ve served on the nonprofit’s board of directors. While the policymaker doesn't directly set mortgage rates, its decisions do influence their direction. Fixed mortgage rates move with the 10-year Treasury yield, while adjustable-rate loans more closely follow the Fed. This table does not include all companies or all available products. Given the many factors that directly and indirectly impact mortgage rates, predicting where rates will go in the years ahead is tricky.

30-Year Mortgage Rates: Trends, Tips, and FAQs - Business Insider

30-Year Mortgage Rates: Trends, Tips, and FAQs.

Posted: Tue, 23 Apr 2024 21:14:00 GMT [source]

For the week ending April 25, the average 30-year fixed mortgage rate stood at 7.17%, according to Freddie Mac. Remember that your mortgage rate is not the only number that affects your mortgage payment. Rates on a jumbo mortgage are normally higher, too, because mortgage lenders have a higher risk of loss. But jumbo loan rates have reversed course and stayed below conforming rates in 2023, creating great deals for jumbo loan borrowers. Currently, a jumbo mortgage is any loan amount over $ in most parts of the U.S. If you took out a $400,000 home loan with a 30-year fixed rate of 6.5%, you’d pay around $510,381 in total interest over the life of the loan.

In today’s hot market, sellers often accept cash transactions ensuring that the deal will close, which can be a risky choice for the buyer. The danger to the buyer is that they may be overpaying for the home. With no appraisal needed for a loan, there is no independent third party providing an estimate for the value of the home.

However, be careful about giving up contingencies because it could cost more in the long run if the house has major problems not fixed by the seller upon inspection. Sunbury predicts the Fed will cut rates by between 100 to 125 basis points starting in May or June of 2024. As far as which direction interest rates go in the years ahead, Fairweather expects declines.

No comments:

Post a Comment